United States Economy Forecast for Small Business

CLR Insights : 9:39min Read

The American economic landscape is in a state of significant flux. For the nation’s small businesses, which collectively represent over 40% of the U.S. GDP and employ nearly half of the workforce, understanding the trajectory of the economy is not just an academic exercise it is a critical component of strategic survival and growth. As we approach , a confluence of slowing economic growth, persistent inflation, uncertain tariff policies, and evolving consumer habits presents a complex set of challenges and opportunities. This data-driven analysis provides a comprehensive forecast for small business leaders, backed by current economic indicators and expert insights, to help navigate the path ahead.

The Macroeconomic Landscape: A Cooling Economy

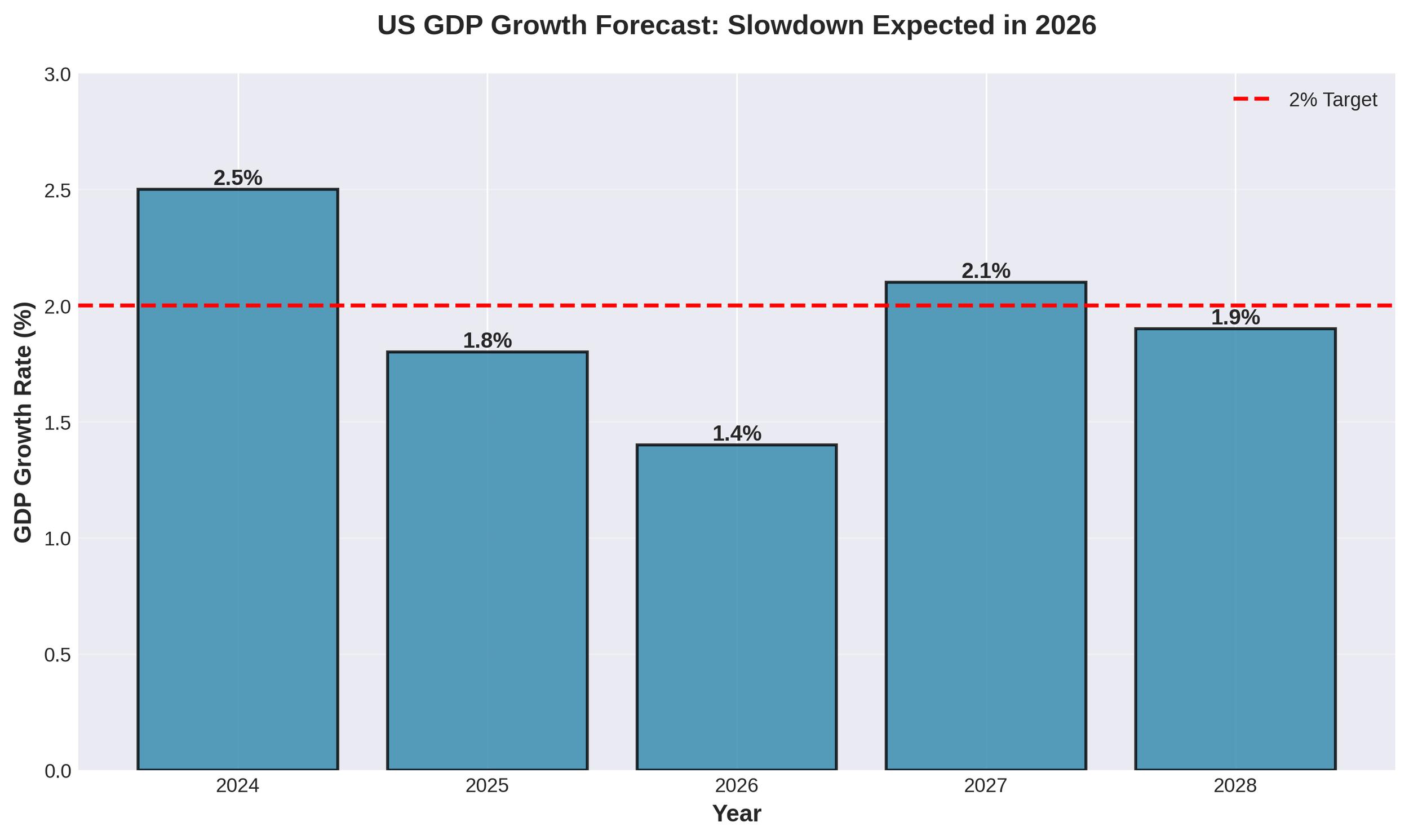

Recent economic projections point towards a period of moderated growth for the United States. According to the Q forecast from Deloitte, real Gross Domestic Product (GDP) growth is expected to slow from 1.8.% in 2025 to 1.4% in 2026, before rebounding in the subsequent years. This slowdown reflects a cooling of the post- pandemic economic fervor, bringing growth below the commonly accepted 2% target.

This cooling trend is coupled with a challenging duo of rising inflation and unemployment. The core Personal Consumption Expenditures (PCE) price index, a key measure of inflation, is projected to climb to 3.3% in 2026, up from 2.8% in 2024. Simultaneously, the unemployment rate is forecasted to rise to 4.5% in 2026. For small businesses, this environment translates to a dual pressure: the cost of doing business rises while the purchasing power of their customers diminishes.

The Tariff Tightrope: A Persistent Burden

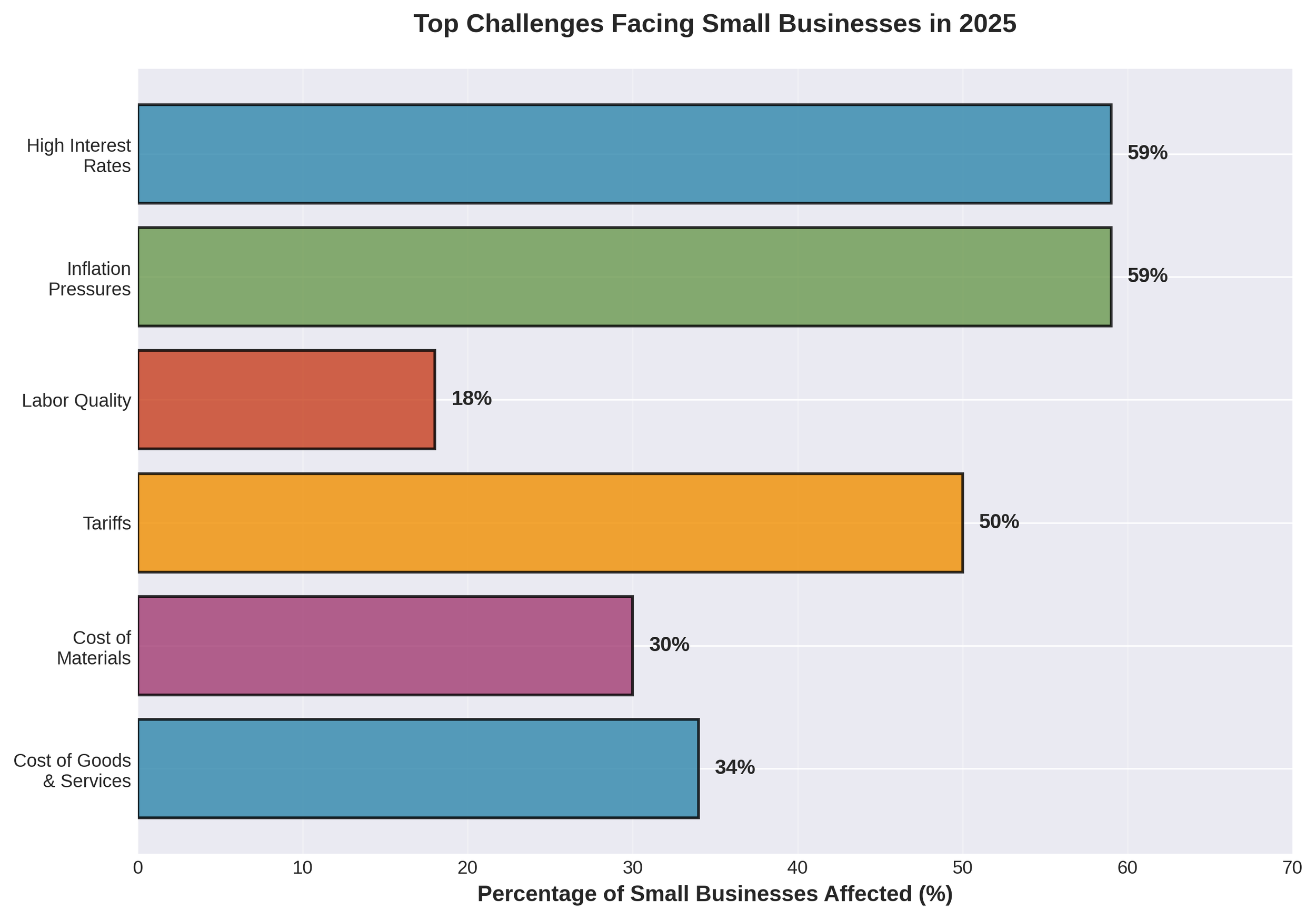

Trade policy remains one of the most significant and unpredictable variables for the U.S. economy. Current tariff policies have placed a substantial burden on small businesses, which often lack the diversified supply chains and negotiating power of their larger counterparts. A CNBC report from October 2025 highlights the severe impact, with some small businesses seeing their tariff-related costs increase by over 600% year-over-year.

“It’s to the point now where it could kill us, it could take us down, and I could lose everything. ... Being a small business owner isn’t worth it when your country turns on you,” said Jared Hendricks, the CEO of Village Lighting, a small business selling Christmas products.”

These are not abstract numbers; they represent real-world struggles. For example, AV Universal Corp., a small footwear company, was forced to take out a high-interest loan to cover a sudden surge in duties, leading to salary reductions and frozen hiring plans. Talus Products, a travel accessories business, has seen a "severe crimp" in its profitability due to tariffs on goods from China.

These case studies illustrate a broader trend. Research from Gusto reveals that 50% of small businesses have been hit harder by tariffs in than in 2025 than in 2024, and among owners who are pessimistic about the economy, 85% cite tariffs as a contributing factor.

Consumer Spending Shifts: The Rise of the Selective Shopper

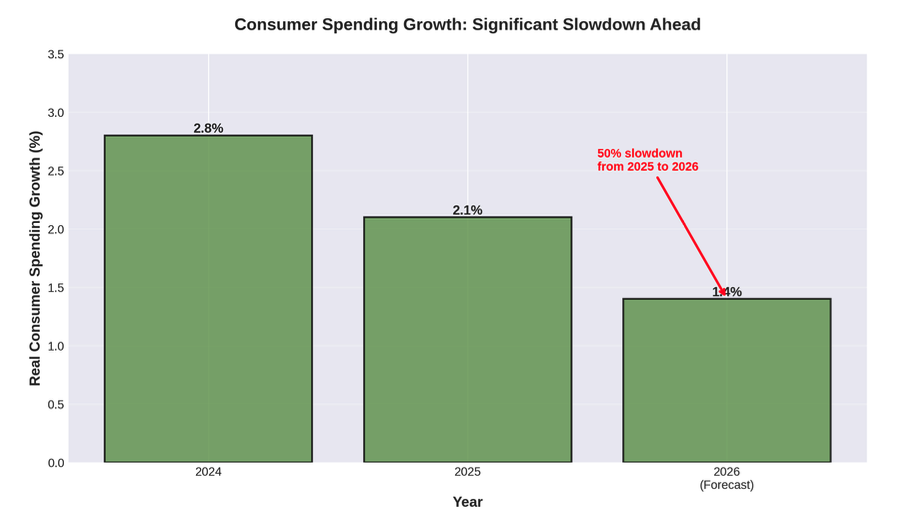

As financial well-being declines, consumer behavior is adapting. A September 2025 report from Deloitte indicates that while consumers feel less financially secure, they are engaging in more selective spending. Overall real consumer spending growth is projected to slow significantly, from 2.1% in 2025 to just 1.4% in 2026—a 33% deceleration in a single year.

This slowdown does not mean spending will cease, but rather that it will be re-prioritized. Consumers are making room for discretionary purchases like leisure travel and clothing, but are more price-sensitive and value-conscious. This trend requires small businesses, particularly those in the retail and consumer goods sectors, to be highly attuned to the shifting priorities of their target audience.

Small Business Sentiment: A Mixed Bag of Resilience and Concern

Despite the formidable headwinds, the sentiment among small business owners is a study in contrasts. While macroeconomic pessimism is prevalent—with half of owners holding a negative view of the U.S. economy a striking 87% report that their own business is meeting or exceeding expectations.

This resilience is reflected in the U.S. Chamber of Commerce Small Business Index, which reached an all-time high of 72.0 in Q3 2025. However, the NFIB Small Business Optimism Index saw a slight decline in September, and its Uncertainty Index rose to its fourth-highest level in over 50 years, signaling deep concerns about the future.

This data paints a picture of entrepreneurs who are confident in their ability to manage their own operations but are deeply wary of external economic forces beyond their control. The primary sources of this anxiety are clear from survey data.

Navigating the Headwinds: What Small Businesses Can Do Now

As 2026 approaches, proactive and strategic leadership is paramount. Business owners cannot control macroeconomic policy, but they can adapt their operations to build resilience and capitalize on emerging opportunities. Based on the current data, here are actionable recommendations:

Looking Ahead to 2026 and Beyond

The economic path forward is not predetermined. Deloitte outlines three potential scenarios for the U.S. economy, with the primary variables being tariff policy and immigration levels.

•Baseline Scenario: Assumes moderately elevated tariffs and lower net migration, leading to the 1.4% GDP growth forecast for 2026.

•Downside Scenario: A

more aggressive tariff stance (~20% average rate) combined with zero net migration could trigger a recession in late 2026, with unemployment rising to 5%.

•Upside Scenario: A more favorable trade environment (tariffs falling to ~7.5%) coupled with stronger immigration could significantly boost consumer demand and lead to more robust economic growth.

This divergence highlights the profound impact of policy decisions on the small business ecosystem. While business leaders must plan based on the most likely baseline, staying informed about these policy shifts is crucial for strategic agility.

Conclusion: The Resilient Leader

The journey to 2026 for America's small businesses will be defined by navigating a complex and often contradictory economic environment. The data reveals a landscape of slowing growth, persistent cost pressures from inflation and tariffs, and a more discerning consumer. Yet, it also showcases the remarkable resilience and inherent optimism of entrepreneurs who remain confident in their own ventures even as they harbor concerns about the broader economy.

Success in this climate will not be about having a flawless crystal ball. Instead, it will be forged through disciplined execution and strategic foresight. By focusing on operational efficiency, building resilient supply chains, cultivating deep customer relationships, and managing finances with prudence, small business leaders can steer their organizations through the turbulence. The challenges are undeniable, but for the prepared and agile leader, the opportunities to gain market share, innovate, and solidify their position for long-term success are equally significant. The future belongs to those who can adapt and thrive in the face of uncertainty.